#DeFi #CMT #CommunityToken #investing #crypto

Community Token

Community Token Finance ( Community Token's) is a non-custodial,cross-chain complatible,delta-one asset protocol. Community Token's long term DeFi vision is to increase inclusiveness and democratize access to investment assets (digital and traditional). Tremendous value exists in the ability for investors to easily and quickly invest,save fees,and secure assets at fair market value. Community Token combines substantial technical experience from traditional global asset management firms to bring to market one of the first DeFi projects built upon Ethereum with cross-chain compatibility Community Token will allow users to build and manage spot or portfolio exposures with a slew of innovative digital and traditional financial products.

Community Token is backed by our Ethereum -based Community Token,Token (CMT) with synthetic assets built on other EVM complatible chains first and other prominent blockchains in the long run, making the staking, investing, and redemption process easier, quicker and with substantially lower transaction fees whilst maintaining access to the Ethereum DeFi ecosy stem.

The CMT token will adopt an inflationary model to enhance staking incentives and will have liquidity mining programs to encourage usage of the exchange and stability of the pool. Synthetization of assets will focus on cryptocurrencies, commodities and, more importantly, traditional assets such as market indices and thematic theme exposures.

The long term vision of Community Token is to provide a platform for any user to gain exposure to a wide range of assets without slippage and settlement time. Furthermore, Community Token finance will act as a reliable gateway with the adoption of cryptocurrency we saw in 2020 and the collaboration of Decentralized Finance ( DeFi ) and Centralized Finance ( CeFi ). Applications can be developed on top of Community Token for CeFi/DeFi composability.

CMT Token-Collateral and Governance

CMT as the Base Collateral with other Digital Asset Options.

CMT Tokens are the Base collateral to create liquids using Builder,which is a decentralized application for collateral pool and liquids management. The creation of Liquids will require a pledge ratio which is over 100% i.e. Over - p[edged. Over pledging is necessary to ensure the volatility of the pledged assets do not adversely affect the stability of the entire system. In the long run, the pledge ratio can gradually be optimized and this will be determined by the community - driven Community Token DAO

CMT stacking Rewards.

Incetives are provided to CMT stakers in the following ways:

Pro-rata exchange fee

Transaction fees are generated whenever a user exchanges one type of liquid to another using our Community Token exchange platform. The initial transaction fee is set to be 0.25%. Stakers will obtain such rewards ( in USD)weekly on a pro-rata basis given that their Pledge Ratio ( P ratio) is above the threshold.

The non CMT-Type collateral part of the stacking ( if any) is only partially entitled to such reward:

Inflationary Reward.

Community Token adopts and inflationary tokenomics with a decreasing rate until a terminal floor is reached. We share the same vision as Ethereum in the sense that the imminent inflation reward is important for the explosive growth of the platform while the long term terminal rate should help stabilizing the total CMT supply in circulation.Currentlly the starting inflation in set as 60% ( of the tokensdesignated for staking) and the inflation going forward depends on the circulating supply and the experted growth of the exchange volume.There will be a yearly review tn the format Community Token DAO.

Uniswap,and Curve to facilitate yield stacking

In addition, we will also be leveraging the use of token rewards to also icentivize user to help stabilize the debt pool in certain instances. When the debt pool becomes unbalanced in exposures e g.if a large number of users create liquids against gold (long), we will provide users who counterbalance this trade by creating a liquid short against gold with additional token rewards, ultimately reducing the volatility and increasing the safety of the debt pool.

Users i.e the CMT stakers hence act as liqudity providers while using the platform at the same time depending on the liquids created, the overall debt level changes according to the overall long /short ratio Below are the 2 major journeys that normal users and market-makers have:

1.Normal Users:

Get CMT tokens via our fiat payment gateway partners, CEXs or DEXs.

Stake CMT tokens via Community Token Builder to build USD.

Get Liquids exposure using USD and exchange among different Liquids via Community Token exchange.

Claim the transaction split and staking rewards.

Convert the Liquids exposure back to USD.

Burn the USD to unlock the staked CMT tokens.

2.Market-Maker

Get CMT tokens via our fiat payment gateway partners, CEXs or DEXs.

Stake CMT tokens via Community Token Builder to build USD.

Depending on the net position of a particular Liquid, for example, if the position of XAU is net long 50% marketmaker can help stabilize the debt pool by doing the other side ( i.e go short on XAU in the case).

Community Token will incentivize the marketmaker to do so by providing extra yield ( i.e CMT Tokens) on top of the inflation/staking reward and transaction fee split for their effort to stabilize the debt pool.

Community Token exchange

1. The Issue

Liquids provide a seamless exposure for all users. Imagine a world without Community Token exchange, when Alice wants to switch her exposure from CAC 40 index to Bitcoin, it would take her approximately two days to get the proceeds from her brokenage account because of T+2 settlement timeframe and another 1 to 2 days for the broker to direct a transaction to Alice's bank account. Afterwards,it would be anothe couple of days for Alice to wire money from her bank account to a cryptocurrency exchange before she can finally switch her exposure into Bitcoin, ultimately exposing her to a potential negative price movement.

2. The Solution

Community Token exchange can seamlessly solve the issue with the debt pool concept and unlimited Liquidity. Any Liquids settlement timeframe can be lowered into seconds with the help of blockchain technology ( as compared to T+2 in traditional securities). Community Token is now working with selected public blockchains with EVM compatibility to further lower the settlement timeframe with block times as low as few seconds and instant finality. In this case we can combine the best of the both worlds the most sought-after tooling and infrastructure of Ethereum and the high TPS of other public blockchains. In addition,when creating Liquids, as it will be on the other blockchains, the transaction fees will be minimal, compared to the high gas fess of Ethereum.The front-running problem of some existing platforms can also be very much alleviated as the oracle will be able to refresh prices in a much higher frequency at much lower fees.

3. For All Investment Exposure

One of the goals of the Community Token exchange is to not only reduce the hassle and risk involved in cross-assets investment but to also expand the breadth of investable assets. Upon our launch, Community Token exchange will support not only cryptocurrency but also trditional assets such as commodities, forex, market indices, thematic exposures, and ultimately equities. In addition, we will start an internal group that focuses on building thematic exposures within the crypto word and traditional equities depending upon the wishes and asks from our users and approved by the governance base. What's more, Community Token will be building our exchange functionalities that will allow users to effectively manage their exposure and additional asset management functionalities such as portfolio management and analytics.

System Architecture

In order to effectively solve the high transaction fee and oracle frontrunning problem of existing DeFis on Ethereum, Community Token is adopting a cross-chain approach by supporting both the Ethereum and EVM-compatible blockchains. From a user's perspective,he would only need to initialize both an Ethereum-based wallet and the EVM- compatible wallet. Operation-wise it would be exactly the same as handling the wallets separately,while Community Token will help pegging the two wallets and record the pegging on smart contracts .

By separating the smart contracts suite of Community Token into 2 different blockchains,the following benefits can be achieved:

As Community Token DAO And Community Tokens ( ERC-20)are deployed on Ethereum we are able to maximize the support from the DeFi Community ( which is the largest on Ethereum so far) and cross-DeFi partnership with other protocols.

For Builder and exchange the smart contract iogic will be deployed on the EVM-compatible blockchains. The entire Liquids building and trading will be nearly free from gas fee,which greatly improves the user experience.

Since the block time of our partnering EVM-compatible blockchains are much lower than that of Ethereum and the transaction fee is almost minimized as compared to the Ethereum side. Community Token enables users to build Liquids with a more prompt oracle price update,making the window for front-running much lower. As such,stakers tokens can be better protected and there will also be less concern on the debt inflation.

The entire process will be optimized and automated in the near future to reduce Any potential friction when cross-chain smart contracts are called.

Community Token DAO

After the launch of the protocol, Community Token will be under the govemance of Community Token DAO on important parameters and platform design such as:

pledge Ratio.

CMT inflation reward and frequency.

Split of transaction fees on areas such as bum,fee claims and Community Token Reserve.

New functianalities and technology roadmap.

Proposals can be submitted by the community and voting will be done to determine whether they should be adopted or not. In between trere will be discussion on cach proposal before the voting so as to ensure the voting is meaningful to the long term growth of the platform.

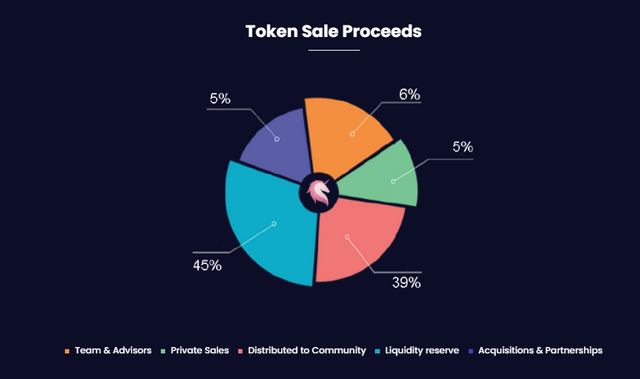

Community Token Power Exchange - Token Sale Proceeds:

Community Token Roadmap

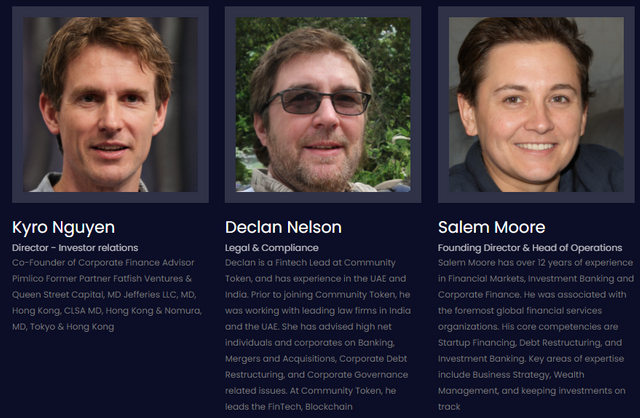

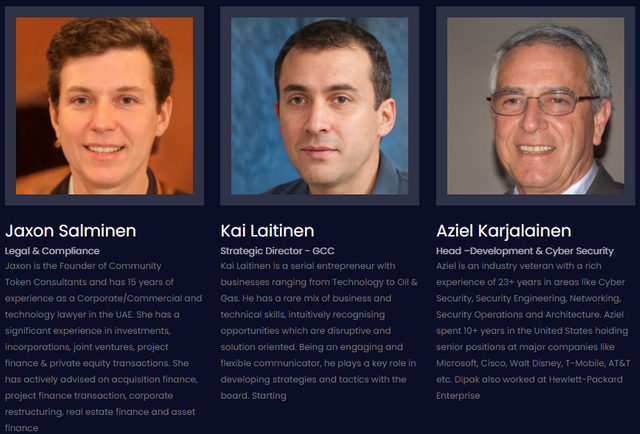

Community Token Team

Conclusion

The team at Community Token, with a strong technical background and financial investment experience is committed to bringing our protocol to market and expanding financial inclusivity to all users. while investing may be difficult,we want it to be easy, cheap, and transparent so that you don't have to be a rocket seientist to build and manage your investments on our exchange. Whilst the above will be our short term goal,in the long term we recognize the value of building Community Token as an asset layer and will welcome app developers to build additional asset management dApps on top of Community Token. Lastly, in the spirit of decentralized finance, upon launch. we will start the planning and transition of our govermance to a DAO, allowing our user community to help and continue to drive innovation and be kay decision makers withm our protocol and ultimately becoming a protocol for users, built by users.

Learn more about the project:

Official Website: https://cmt-token.top

Official Telegram channel: https://t.me/CMT_token

Official Telegram group:: https://t.me/CMT_token_group

Official Twitter account: https://twitter.com/CommunityToken2

profile :

bitcointalk username : Ainulyaqin

bitcoin talk url : https://bitcointalk.org/index.php?action=profile;u=2787764

telegram : @Ainulyaqin472

ETH : 0x1B7BE3cdd815FAf96a141D1FCABfFFc66D8cE36a

Tidak ada komentar:

Posting Komentar