Introduction

The increasing need to assess creditworthiness against secure and authentic data backgrounds, however, presents unique opportunities for entrepreneurs to implement innovative solutions.

Defi is a calculating project that enables the availability of authentic and reliable credit risk data for lenders. The Defi system allows several lending institutions to collect borrower data through a highly secure cross-company data collaboration platform. The underlying blockchain-based protocol ensures that data is decentralized and is not owned by a single party. The platform also leverages trusted computing technology that takes privacy protection and information security to the next level. This creates ideal conditions for lending institutions to extract value from data safely.

Rain.Credit

Rain.Credit is a service that provides information about a customer loan application to reduce the risk of default, excessive risk taking and criminal activities to investors. The more information provided by the borrower, the less collateral needed to borrow and the more funds available to be borrowed.

We are increasing access to loans for customers through rain credit DROPS by analyzing customer payment history in binance smart chain, ethereums native chain as well as other third party chains in exchange for access to more loans and other services.

Rain credit DROPS is simply the extra amount of RAIN tokens we offer borrowers without any extra collateral based on their transaction history and rating from rain credit Off-chain Oracle Analytics Aggregation.

The problem with Oracle Lenders on Ethereurm

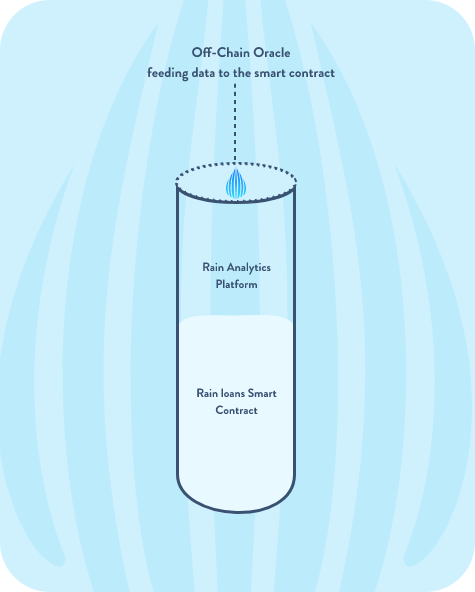

Ethereum’s smart contracts are completely self-contained and any data or access to off-chain data is limited. For security purposes, this is necessary because execution in blockchains must be deterministic and the reaction to subsequent calls to outside APIs can change in unknown ways. Nevertheless, with additional outside data, aggregating multiple information data from multiple chains some desirable forms of smart contracts functionality are feasible.

An Oracle is a conceptual solution that takes off-chain information from the real world and submits an immutable copy of this information into blocks, making it open for future use of smart contracts.

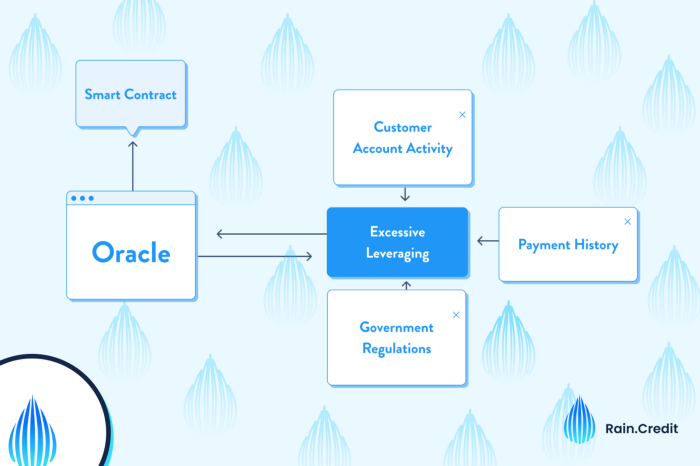

Example of Real world events that can affect on-chain loans and chances of default include but not limited to;

- Customer account activity

- Payment history

- Excessive Leveraging

- Government Regulations

Accessible Intelligence off-chain

Real world events and customer information accessible off-chain would be used to improve authenticity of borrowers and further alleviate the risk of default. Intelligent Information such as transaction history, loan history, account transaction history, liquidations on Bsc chain, ethereum native chain as well as other proprietary chains api’s will be analyzed for defaults and other activities.

Transaction history and Account forensics

Loan Tracker information provided by bscscan, etherscan and using the graph api’s to analyse compound, aave, cream and other loan offering protocol data about a user’s address will be used to create a Credit Score on the user’s address. This credit score will be used by investors to gauge a borrower’s credit rating thus minimizing losses and default risk.

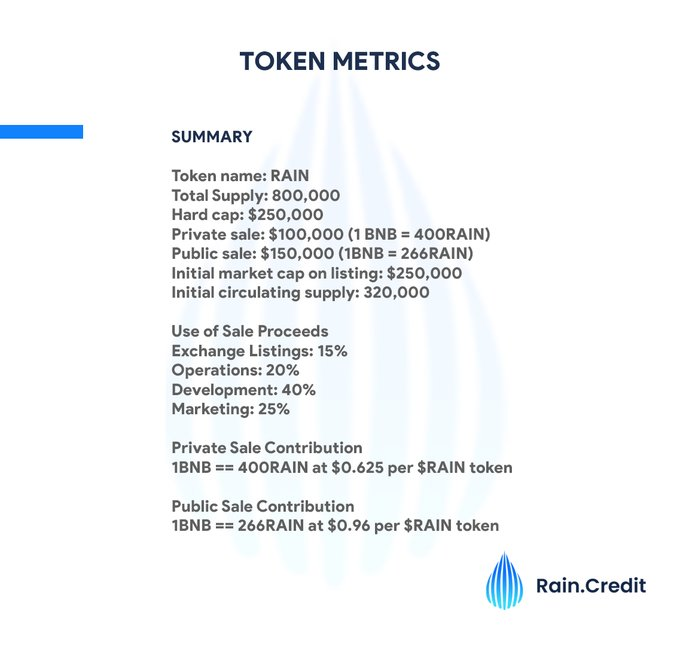

$RAIN has a simple distribution model. It’s total supply consists of 800,000 $RAIN. The token distribution is as follows:

● 40% will be sold via presale

● 20% will be used for project development

● 20% will be used to provide Liquidity and yield farming

● 10% tokens will be allocated for team (For 2 years, these tokens will be locked to instill confidence in the community)

● 10% will be used for marketing

Roadmap

Q2–2021 (Testnet Season)

Our focus for the second quarter of 2021 is to get the platform in full gear with the Oracle and Lending platform working effectively on the testnet within a short period of time. We also aim to further build on the Oracle platform by building the “Trust Network”, which motivates data providers.

- $RAIN token Presale (read more)

- Exchange Listings

- Testnet Off-Chain Aggregation Oracle Analytics

- Testnet Lending Platform.

- Testnet Trust Network

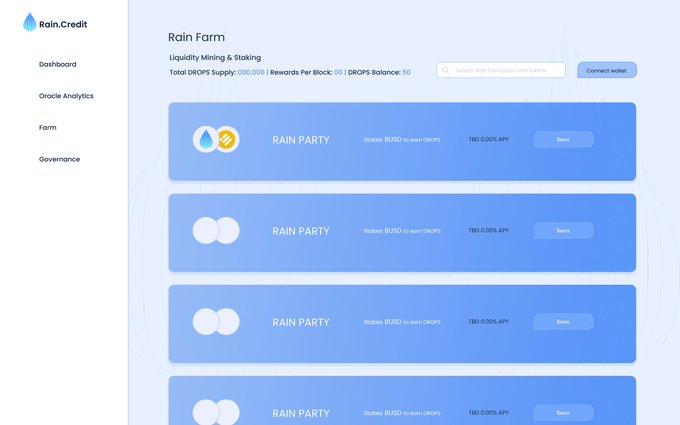

- Deflationary Staking and Farming Launch

Q3–2021 (Mainnet Season)

Our focus for the early third quarter of 2021 is to get the platform in full gear with the Oracle and Lending platform migrated from Testnet to Mainnet within a short period of time. We also aim to further build on the Oracle platform by launching the “Trust Network”, which incentives data providers.

- Contract Audits Lending and Oracle

- Mainnet Off-Chain Oracle Analytics

- Mainnet Lending Platform

- Aggregated Data Providers

- Trust Network

- RAIN Oracle Hackathon

Q4–2021 (Middleware Season)

This quarter will be heavily focused on middle-ware integration and an exciting period for our community with the RAIN drops Governance DAO launch.

- Oracle Network Release 2.0 (Beyond Aggregation Analytics)

- Off-Chain Oracle Marketplace Release supporting multiple chain

- RAIN GraphQL Abstraction Layer Launch

- RAIN Governance DAO

- Off-Chain Asset Management and Monitoring Platform Release

- Off-Chain Asset Management and Monitoring Platform Release (One-Click Integration with non-blockchain based platform)

- Comprehensive API and Documentation Release

Q1–2022 (Cross-Chain Season)

First Quarter will see a focus on Cross-Chain integration beyond the Ethereum network with a view to make our services available across multiple blockchain networks.

- Cross-Chain Collateral Lending

- Cross-Chain Oracle Launch

- Smart Contract Analytics Platform

- Cross Chain Trust Score (Beyond Ethereum Network)

- Asset Group Trust Score

- Continuous development and improvement of the Trust Network

- Academic research and publication of Trust Score impact in the DeFi sector

Rain.Credit Team

Rainbuilder / Lead Developer

Hail / Developer

Drizzle / Community Manager

Monsoon / UI/UX Designer

#RainCredit #Blockchain #cryptocurrency and #BNB

For more information Connect to the Rain Project. Credits:

● Website: https://rain.credit/

● Telegram: https://t.me/joinchat/UqEl0GyJZ4WkDUWR

● Github: https://github.com/orgs/Rain-Credit

● Medium: https://rain-credit.medium.com/

● Twitter: https://twitter.com/rain_credit

● Discord: https://discord.gg/aEc7NWbU

#RainCredit #Blockchain #cryptocurrency and #BNB

profile :

bitcointalk username : Ainulyaqin

bitcoin talk url : https://bitcointalk.org/index.php?action=profile;u=2787764

BNB : 0x1B7BE3cdd815FAf96a141D1FCABfFFc66D8cE36a

Tidak ada komentar:

Posting Komentar