It isn't all about creating projects on DeFi, but providing a solution to problems traders face everyday. Some projects do not have anything to offer users, or even if they do, they do not back it up safely, and at the end of the day, the trader ends up losing their funds. The Mocktail Finance has a lot to bring to the table. They have staking, farming and swapping projects under the Mocktail ecosystem as they are looking for numerous means to provide multiple yield to the users on their platform through the Binance Smart Chain network, a growing blockchain network which most projects are beginning to adopt massively.

MOK token

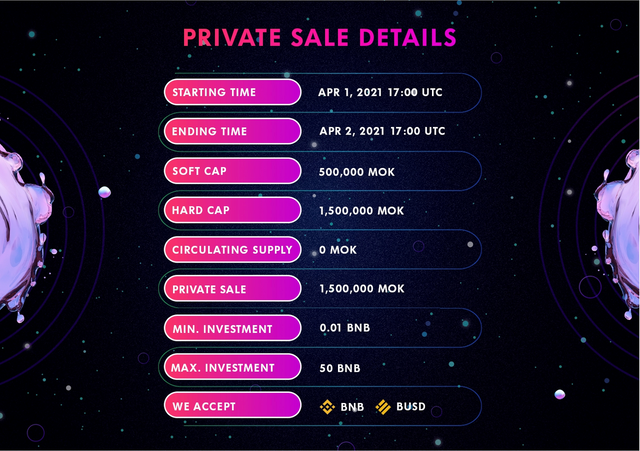

The token of the MocktailSwap platform is the MOK token which is the first semi-fungible token to be launched on the Ethereum network. It is an ERC-1155 token which is a rare token. The token handles the activities of the platform as it is a governance token. The MocktailSwap provides a safe and fast means for users to exchange their decentralized tokens. The ERC standard SFT is a standard that allows contracts who can handle different types of tokens. A single contract might contain an NFT or Fungible tokens.

Features of MocktailSwap

This platform lets the community have access to the different decentralized features made available on the platform, and has been successfully built in the BSC. Through Mocktail, the users can make good use of the projects, and earn so many profits from it. They can also trade tokens on MocktailSwap for a low fee.

- ERC-1155 token standard: The platform's token is based on this token standard, and is run on the BSC network. It is the first kind of token standard to be built on the BSC network.

- Trade: The platform permits their users to trade their tokens for a small charge.

- Yield farming: While other users earn through different means on the platform, the liquidity providers earn when they lend out their tokens through a means called smart contracts. In return, they are greatly rewarded.

- Liquidity: A liquidator gets profits based on their contribution to a liquidity pool. A certain amount of trading fees also goes to liquidators for providing liquidity to a pool.

- Stake: Here, the users stake their tokens, and in return they get rewards for their participation.

Why use BSC?

There is no sensible reason to make use of a blockchain network that is slow when carrying out transactions, and also costs more. There is high liquidity on the platform, so there'll be more deposits and withdrawals carried out all the time. This means that there would be a need for low fees and faster transactions for better yield and outcome of the project.

The BSC network is not as recognized as the Ethereum network, but it doesn't matter because it is believed that with time, the BSC network would also reach that height. It is currently being used by so many projects in the DeFi world, and we all have high expectations for it.

For more information on MocktailSwap :

Website - https://www.mocktail.finance/

Website - https://www.mocktailswap.finance/

Telegram group - https://t.me/MocktailSwap Whitepaper - https://docs.mocktailswap.finance/

Twitter - https://twitter.com/MocktailSwap

Facebook - https://www.facebook.com/MocktailSwap/

Profile :

Tidak ada komentar:

Posting Komentar