The subjectivity of the permanent loss of staking LP (liquidity provider) on farm reward generators is a widespread misunderstanding with high APY averages. With the DeFi boom, we’ve seen far too many novice cryptocurrency miners be pulled into the trap of high LP APY farming, leaving them feeling hopeless after being forced out by prior purchasers in return for larger investments. We’ve all been there: seeing that gleaming 6-digit figure may be enticing.

Tokens, on the other hand, nearly always suffer an unavoidable valuation bubble, which is subsequently followed by an approaching price explosion and crash. This is why we’ve seen such widespread adoption of static incentives, sometimes called as reflection, a different idea that aims to avoid the issues produced by agricultural rewards.

WHAT IS KEYFUND?

KeyFund’s secret sauce is Auto LP. Meet the finest Autonomous Yield Tokens that are ready to develop and willing to shatter the crypto industry’s limits with a unique deflation mechanism. Tokens having a limited quantity, a perpetual liquidity lockup, and burning on every transaction.

Automatic Liquidity Pool (LP) :

KeyFund’s secret sauce is Auto LP. In this case, we have a function that serves as a dual-purpose implementation for the holder. First, the contract takes the tokens from the seller and buyer and adds them to the LP, resulting in a stable price floor.

Second, the penalty functions as an arbitrage-resistance mechanism, ensuring that the KeyFund volume is secured as a reward to its holder. In principle, the additional LP creates the stability of the given LP by adding a tax to the overall liquidity of the token, therefore raising the overall LP of the token and sustaining the token’s underlying price. This differs from other reflection token burn algorithms, which only benefit from a certain supply drop in the short term.

Price stability reflects this capability as LP KeyFund tokens rise in value, benefiting from a strong price foundation and cushioning for holders. The objective here is to avoid a larger decrease when the whales decide to sell their tokens later in the game, which avoids the price from changing as much as it would if there was no auto LP mechanism.

Auto Burn :

Sometimes there is burning stuff, and sometimes there isn’t. Continuous burning on any of the protocols can be quite beneficial in the early stages, but it implies that burning cannot be regulated or controlled in any manner. Having burns managed by the team and elevated based on accomplishments keeps the community rewarded and informed. The circumstances and amounts of manual burning can be marketed and tracked.

KeyFund intends to pursue a long-term burning strategy that is advantageous to all parties concerned. Furthermore, the entire amount of KeyFunds burnt is presented on our website readout, providing for greater transparency in determining the current circulating supply at any one time.

Pre-sale :

- Circulating supply: 110,000,000

- Token Sales : 77,000,000

- SoftCap : 22,000,000

- Start Time : August 6

- End Time : August 8

- min. Investment: $10

TOKENOMIC :

- 5% advisor

- Marketing: 5%

- Founder 20%

- 70% Sales

Token Distribution :

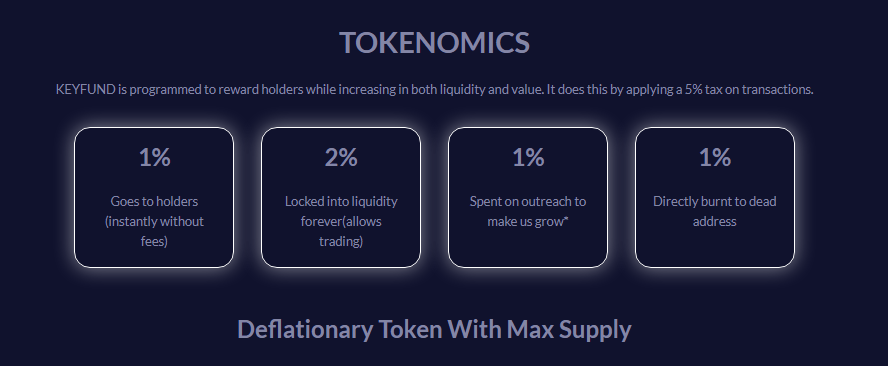

The KEYFUND is designed to reward investors while boosting liquidity and value. This is accomplished by levying a 5% charge on all transactions.

- 1% : Goes to the holder (directly at no cost)

- 2% : Locked into liquidity forever (allows trading)

- 1% : Spending outreach to make us grow

- 1% : Directly burned to a dead address

Roadmap :

More Info :

Website: https://key.fund/

Whitepaper: https://key.fund/whitepaper/

Telegram: https://t.me/Key_Fund

Medium: https://medium.com/@Key_Fund

Reddit: https://www.reddit.com/r/KeyFund/

Twitter: https://twitter.com/Key_Fund

Facebook: https://www.facebook.com/KeyFundFinance

bitcointalk username : Ainulyaqin

bitcoin talk url : https://bitcointalk.org/index.php?action=profile;u=2787764

Adress : 0x1B7BE3cdd815FAf96a141D1FCABfFFc66D8cE36a

Tidak ada komentar:

Posting Komentar